A tale of two cities for the marketing insights industry

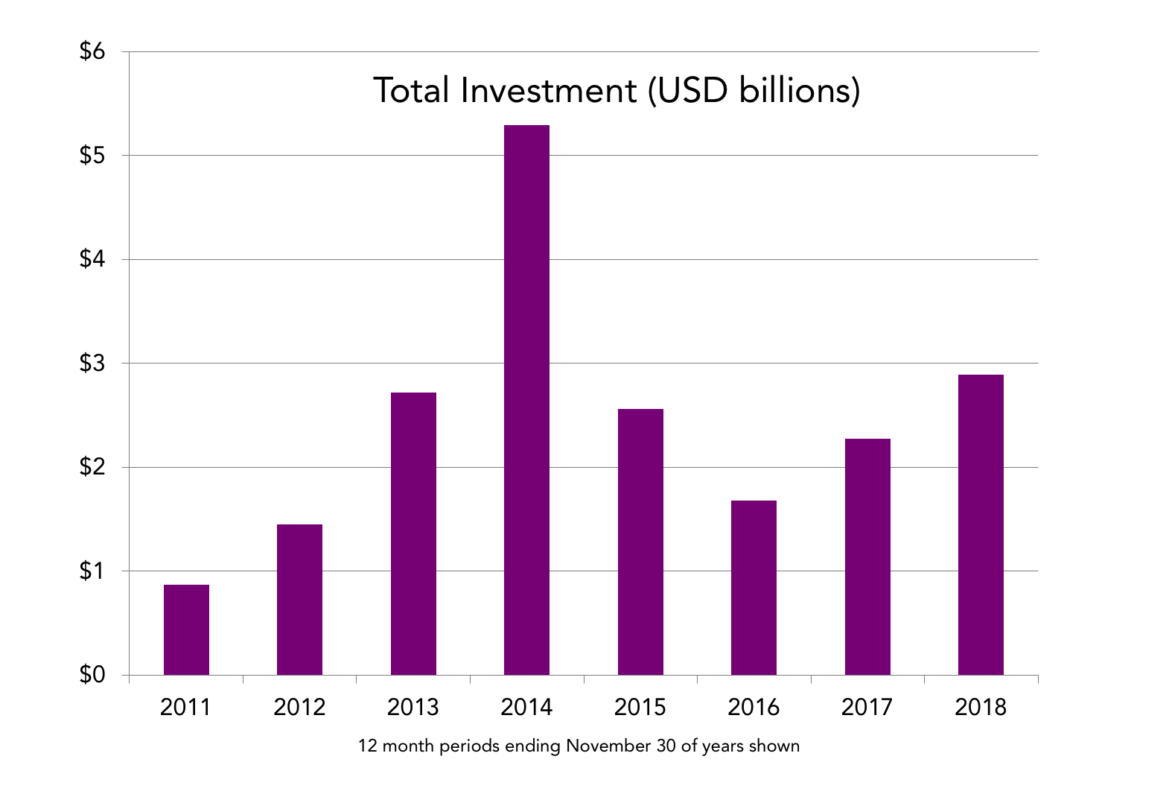

2018 saw a healthy increase in the amount of inward capital invested in the marketing insights industry but with fewer investors putting their bets down on fewer companies than has been the case since 2011 when Cambiar started its Capital Funding Index. The combination of an increase through fewer transactions and by fewer investors suggests that the trend we have commented on in the last two years is alive and well.

That trend was the tendency of investors, after a tsunami of investments in 2014, to double down on their successes and reduce their bets on new ventures. After all, Private Equity and Venture Capital – the prime sources of new investment in industry – tend to raise discreet funds in waves and, once invested, seek to maximise the returns on those investments for that particular fund’s backers. Only when that is being achieved will they then raise new funds and go looking for new sources of return – usually not in the same exact sectors on which they have concentrated in the past. To a large extent that is exactly what is happening here. Except that, this year, there is a significant twist – this year’s story is indeed a tale of two cities.

With a unicorn

That story is in the numbers. Cambiar tracked 67 discreet investment transactions in 2018 – way down from the peak of 152 in 2014 and a significant drop even from last year’s paltry 86 transactions. But those 67 infusions resulted in US $2.89 billion being pumped into the industry – a 27% increase on the year before. Given that we believe we only see about 80% of the transactions that actually take place (many are unannounced or do not reveal the amount invested), this would suggest the total inward flow to have been $3.6 billion in 2018 – the second best result we have seen in the eight years the index has been in existence.

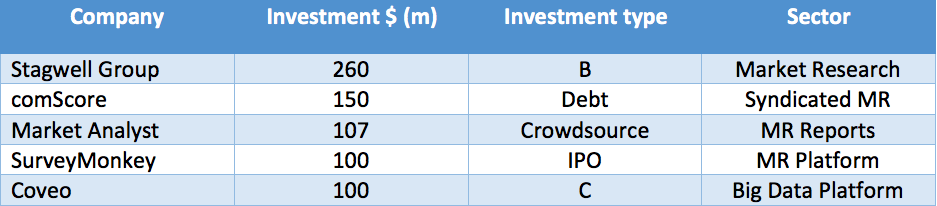

The average transaction size was $43.1 million – an increase of 63% after a corresponding 69% jump the year before. As is becoming a pattern in a maturing market, just seven of these infusions (into six firms) accounted for two-thirds of the money invested. One company – Sensetime, a Hong Kong-based facial recognition and video analytics firm that has become a “unicorn” (a firm worth over $1 billion) in just four years – received two infusions of $600+ million each from Alibaba and others. The other five firms in this group received between them $717 million.

A couple of very unusual things pop out of this particular analysis:

- Four of these are market research firms – even if not in the traditional sense. MR has traditionally been outpaced by analytics in terms of funding, so to find four in this “top” list is surprising. Stagwell Group, in particular, is of interest, since this is a polling and MR holding company founded by Mark Penn.

- Market Analyst’s raise is the first time we have seen such a large sum accessed through crowd sourcing. Usually this is reserved for very small seed fund raising and does not feature prominently in our analyses.

(Note that Qualtrics’ $8 billion acquisition by SAP is not included in our index, since this was an outright acquisition, not an injection of new funding).

Doubling down?

The other 60 transactions that we tracked shared $960 million between them, for an average transaction size of $15.7 million. This represents a 21% increase over 2017, initially suggesting a continuation of the “doubling down” trend. However, careful analysis of the data suggests that there are in fact two stories here.

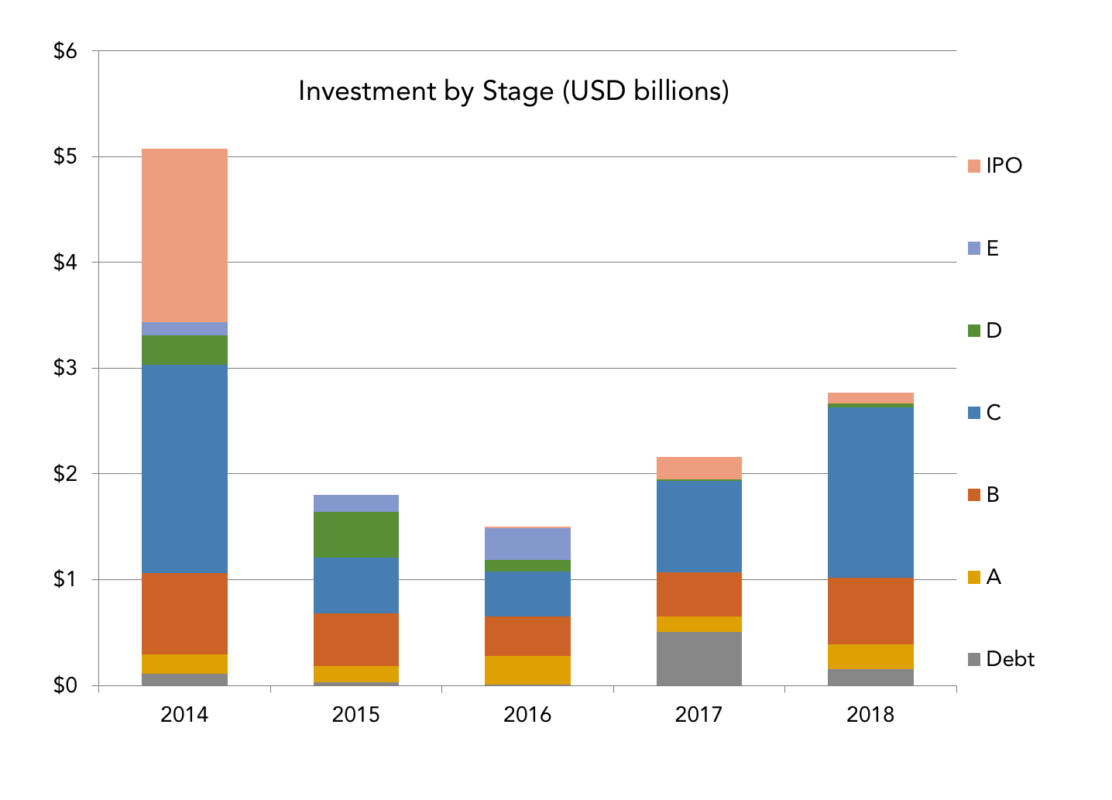

- Supporting our hypothesis is the fact that there was more Series C funding raised than at any time in the last five years – a Series C phase represents investors pumping money into a company that is showing real signs of sustainable success.

- But at the same time we are also seeing more Series A and B funds being invested than at any time since 2014 – and even higher if you look at these as a proportion of overall funds raised. These are early stage monies injected into companies that look to have good ideas that are not yet necessarily proven.

Funding definitions

Seed: very early stage funding, usually at the beginning of a company’s life

Series A through E: sequential rounds of equity funding as the company grows, with “A” being the first in the series; usually these rounds are funded by venture capital or private equity funds which then become shareholders of the company

Debt: funding, often carried out by banks, that injects capital into a company; that capital then becomes a debt obligation for the firm – funders become creditors rather than shareholders

IPO/Stock Issuance: a public stock offering to raise capital.

More confidence

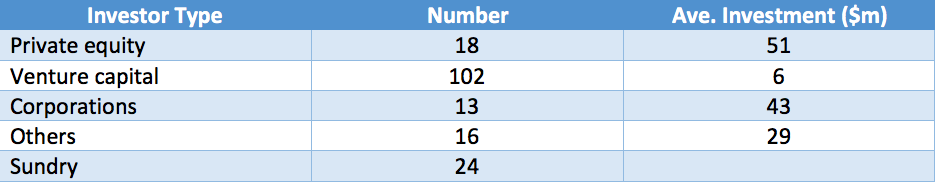

What this suggests is a resurgence of interest in our sector in terms of funding initial start-ups and early stage companies. It can be read as a sign of confidence in the sector among the investment community based on previous results. That this may be happening is supported by looking at who is investing. While the stalwart believers in our industry such as Sequoia Capital, Insight Venture Partners, Andreessen Horowitz, Lightspeed Venture Partners and Norwest Venture Partners all feature yet again this year, the startling fact is that, of the 173 investors who threw their money into the Insights ring in 2018, over 90 of them are completely new to the sector. This would suggest that those who sat out the first round (2012-2014) have been sufficiently impressed by the returns that they too have decided to join in the fray. This is brought into stark relief when we look at the profile of investors in the past year.

The presence of Private Equity speaks to the maturation of investments made in previous years – these are typically funds that exist to take mature firms on to further growth and profitability before either selling them to strategic acquirers or floating them on the stock market through an IPO. Venture Capitalists, on the other hand, are more willing to endure the risk of putting funds into unproven early stage firms in the hope that a few of them (think Qualtrics) will turn out to be a winner. This speaks to a new round of confidence in emerging companies in the sector.

As a factoid of interest for the geeks among us, a total of 1,313 separate entities have invested in the insights industry in the last five years.

Categories

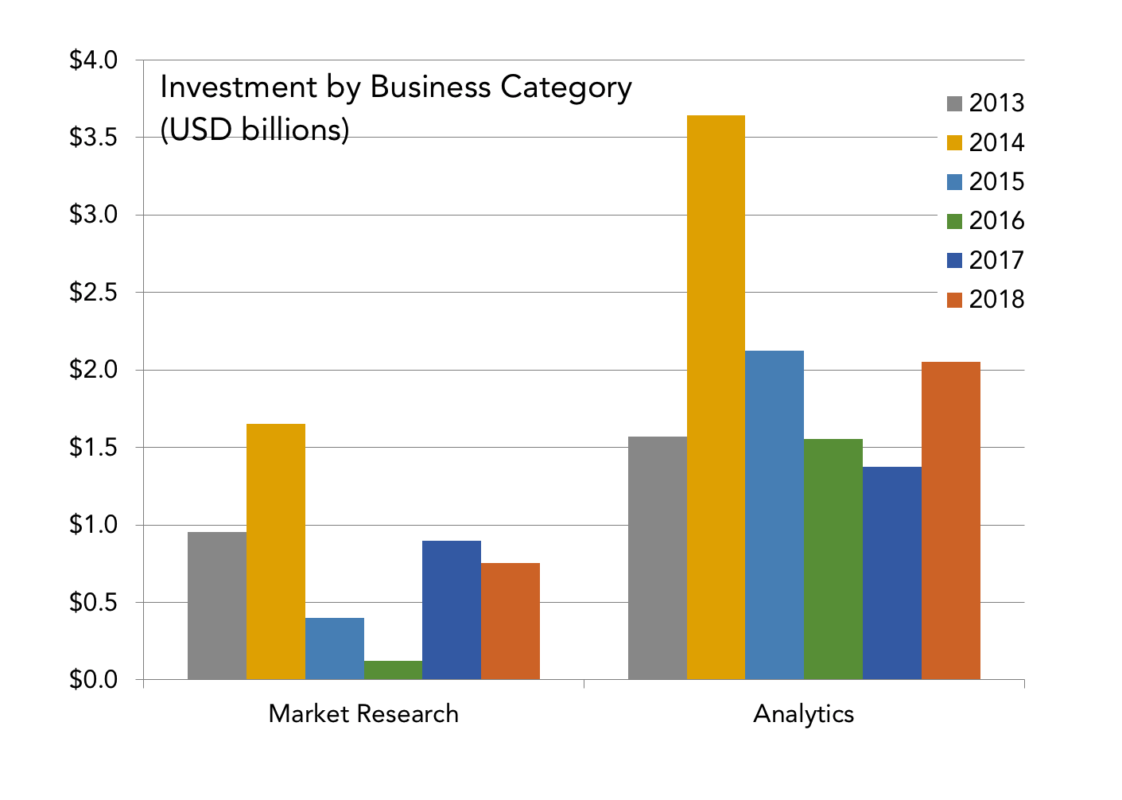

But where have they been investing in 2018? We mentioned a few prominent market research investments this year and, indeed, the sector held up relatively well, even if still well-outpaced by analytics.

In addition to the bigger transactions in MR that we saw earlier, there were also investments in smaller, emerging enterprises in areas such as audience measurement, data collection platforms, advertising effectiveness, segmentation, communities, panels and medical MR.

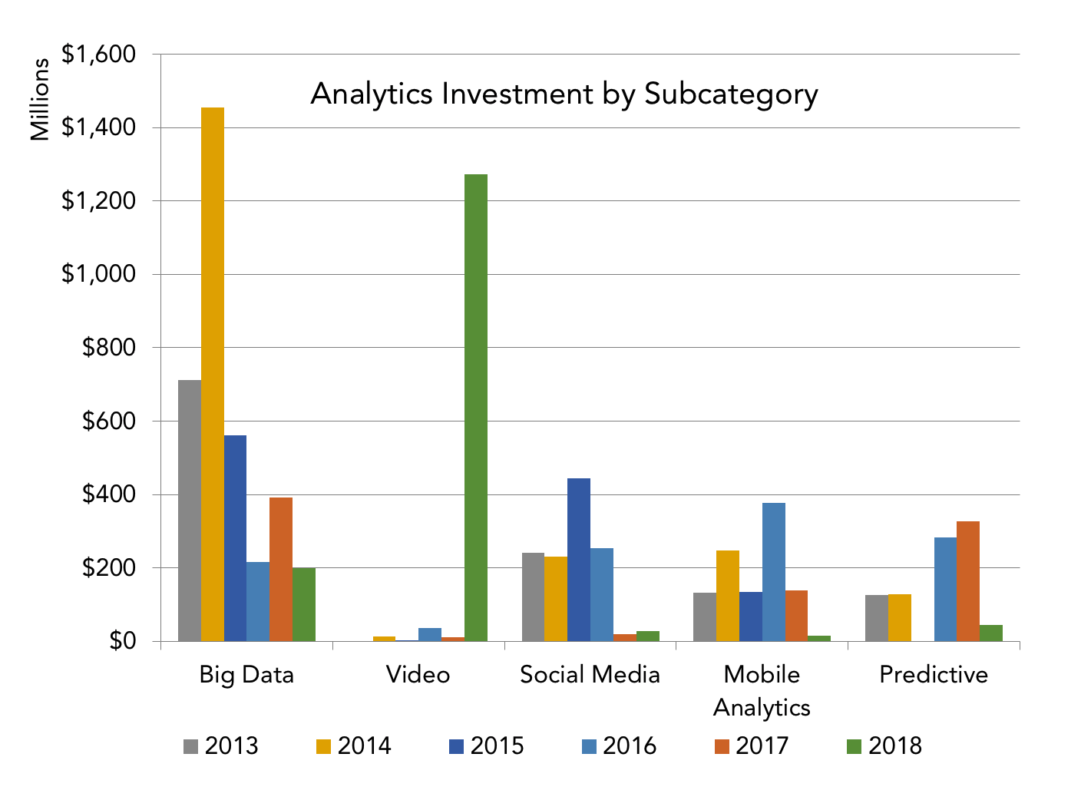

In the analytics arena, the big standout was video analytics.

The vast majority of this was due to the two tranches of investment in Sensetime, which also explains the rise of Asia as a funding destination this year. Also notable is the decline of investment in firms describing themselves as being in “Big Data analytics”. This is clearly “so 2014” and has been replaced in many self-descriptions by the words “Artificial Intelligence” and “Machine Learning”. We have elected not to show these as separate categories as they can be (and are) applied to virtually anything that moves in the analytics sphere and, as such, have lost a lot of their meaning.

So, in the midst of the successes from the original 2012-2014 wave of investments maturing, are we now seeing a renaissance in capital being deployed in emerging insights firms? Last year we said that would be “anyone’s guess”. This year, we call it a pretty good bet. Investment in our industry is alive and well.