Market and insights firms must ensure that they not only truly understand but also meet the needs of their customers during the pandemic. We talk to Matthew Powell, a Managing Director from B2B International, about the most successful strategies of B2B CMOs, based on the findings of a B2B International and Merkle B2B study analyzing the views of 908 B2B CMOs across 12 countries.

We start by asking Powell about the top five challenges B2B CMOs expect to face over the coming 6 to 12 months. He explained that when asked about different challenges that they faced, the one that came up most frequently was understanding what is a temporary versus a permanent change in customer behavior (40% of the respondents). This is true for 46% of North American CMOS vs 38% in APAC and 36% in EMEA.

Powell comments “We see firms that have been serving their customers more remotely for example, who are asking if this is going to stay and will customers accept this in the future. Or firms that might have had live visits from their support teams previously. Now that’s all done remotely but in future, will it need to change back to how it was before?”

The study shows that the second most important challenge is to align with new and changing customer sentiment (39%), the third is declining customer spending (37%), the fourth is managing changes to the workforce (35%) and number five is obtaining the right data to make timely and appropriate decisions (34%). These are all closely linked to understanding the lay of the land and then adapting to it.

CMOs in APAC are much more likely to see ‘disruptions to supply chain’ as a key challenge (32% in APAC vs 22% in EMEA and 22% in North America).

Winning strategies

60% of respondents said that their companies were somewhat or significantly impacted with lower revenue, with 6% saying they might not be able to recover. However, a surprising 34% either said that the outbreak had helped their business or that disruption had been minimal.

We ask Powell, what are the factors that separate the winners and survivors from the less successful?

“What we see is that the companies that have been less impacted and feel they are more prepared for the future, are those that have taken a more holistic approach to marketing and are more collaborative across different departments. This means that the organization has been able to adapt quickly whether that’s through interesting new propositions such as direct to consumer or developing the e-commerce capability. The CMOs have researched their customers, have a good grasp of what their needs and challenges are and how they are evolving, and then adapted to that. These companies are acting more cohesively. This suggests that marketing is playing an important part in the organization as a whole which is more forward thinking and more adaptable.

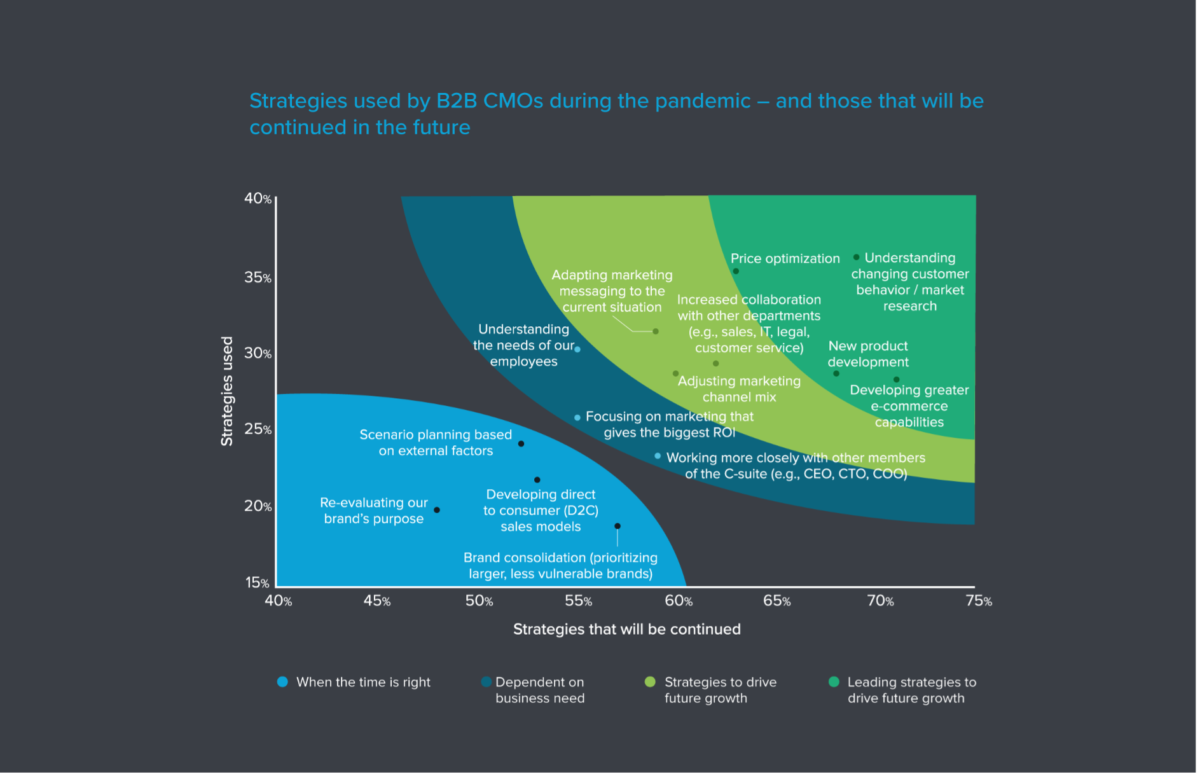

“As a researcher, I was pleased to see that understanding customers’ behavior and using market research was the number one factor in terms of the strategies that were deployed to adapt to the pandemic which will be continued in the future. We did some analysis to pinpoint the sweet spot of the strategies that had been used and would be continued and called these the ’leading strategies to drive future growth’. Four strategies came up, and at the very top is understanding changing customer behavior and market research.”

The other three strategies revolve around price optimization, new product development and developing greater e-commerce capabilities. Unsurprisingly these relate to the traditional four Ps that constitute marketing, product, price, place and promotion. Powell predicts that these four strategies will continue with just under 70% of those who had deployed market research, planning to continue to do so.

The study, which covers a wide array of business sizes and sectors, identifies a cohort of CMOs who are at the ‘frontier’ in leading the way and ensuring that their organizations can be highly effective in the new environment. Those who are less prepared, were classified as ‘the followers’.

Powell notes that “The frontier CMOs are extremely well prepared for the future, their businesses are set up for success and market research is absolutely crucial to their approach.” Frontier CMOs are more likely to work in technology (56%), pharma & healthcare (53%) and finance & insurance (52%).

The top three priorities for success

The top marketing priority in the professional and business services is delivering business growth, followed by developing the overall customer experience, and then understanding customer needs and market trends.

According to Powell, customer experience means everything from how the brand presents itself in marketing to the digital experience, the culture within the organization and how that manifests itself, including how people speak to customers on the phone. Winners take a holistic look at the customer experience and develop that as a point of differentiation. Responsiveness and reliability are an intrinsic part and Powell notes that this crops up repeatedly in B2B studies as a key factor that can make or break an experience.

“Customers need to feel that they get a responsive service and how they are spoken to by a service representative, sales or account manager is a proxy for how that organization deals with their customers. Organizations that score high on customer experience, score highly on customer satisfaction.”

The top strategies

Three extremely effective strategies used by all the CMOs irrespective of whether they were a frontier or follower were understanding changing consumer behavior with market research, adapting marketing messages to the current situation and price optimization.

However, two specific strategies distinguished the frontiers from followers: developing greater e-commerce capabilities and increased collaboration with other departments. The latter came up frequently, probably because the goals of the marketing department are elevated so things are done more quickly.

Powell added “For a sector like market research and insights, as with other companies in the professional and business sector, adapting to changing client needs is critical. This presents a key opportunity as research and insight agencies are perfectly placed to help businesses solve this crucial ask. Understanding changes in customer behavior is the most important strategy for future growth. Furthermore, one of the biggest asks of agencies by B2B CMOs (44%) is ‘delivering competency in technology and data’.

The study shows that both frontier CMOs and followers are accountable for growth of the customer base as a top metric. But frontier CMOS are significantly more likely to have a wider remit and accountability for more business metrics. These can include product and service innovation, medium to long-term brand health and the delivery of digital transformation programs, the latter showing the biggest difference (61% for frontiers vs 44% of followers). These are strategic areas meaning the CMO is more embedded in the organization and working with different departments that are responsible for the business.

Different approaches for generations

B2B International also looked at the differences between Baby Boomer (born between 1946 and 1964), Gen X (1965 and 1980) and Millennial (1981 and 1996) customers. This separate study differentiated between the balance of factors when choosing a supplier, that add benefit to the business (a ‘business value-add’) and those that add benefit to the individual (a ‘personal value-add’).

The global study, covering 3094 interviews with buyers and key decision-making influencers, related to the purchase and use of financial services, manufactured goods, professional services and technology solutions, identified four main superpowers. The first two superpowers are reliability (being trusted to deliver) and understanding (knowledge of the client’s business) which add value to the business. The other two are enrichment (making work more enjoyable and interesting, teaching new skills and knowledge) and pre-eminence (being a company that the buyer is proud to be associated with) which are personal value add-ons.

Reliability and feeling safe contracting the company were important across generations. The study shows that Millennials and Gen X need providers to demonstrate that they comply with regulations and standards with Millennials needing extra support and expertise to feel assured that the product and service will deliver. For Gen X it is particularly important that providers help them demonstrate to their colleagues, clear business improvements such as increased revenue or productivity. These priorities should be reflected in the materials that providers supply to help guide customers through the buying journey.

Understanding is important across the generations and is common to all stations of the buying journey and suppliers. It is crucial that B2B businesses are approachable and transparent providing clear and easily accessible information.

Some of the biggest generational differences are apparent within the personal value-add areas and this is where B2B companies could be doing more. Whilst individuals differ, generally companies could consider tailoring approaches more to the needs of the different cohorts. For instance, Millennials want providers to make work more enjoyable for them, GenX want to work with a provider that will teach them new knowledge and skills, and Baby Boomers want suppliers to help them grow their personal network.

The study showed that B2B companies are generally good at selling to other businesses but could do better at selling to the different individuals who are part of the buying decision unit, each of whom will have different needs and wants.