With a forecast 2019 economic growth of +6%, Kenya’s economy is showing signs of stability on the back of macroeconomic steadiness, yet at a micro level Kenyans are seen to be experiencing the perfect storm.

Amongst comparable African countries, Kenya stands out as the country with the lowest GDP per capita (Purchasing Power Parity) of US$ 3,491 (Côte d’Ivoire: US$ 3883, Ghana: US$ 4729, Nigeria: US$ 5929).

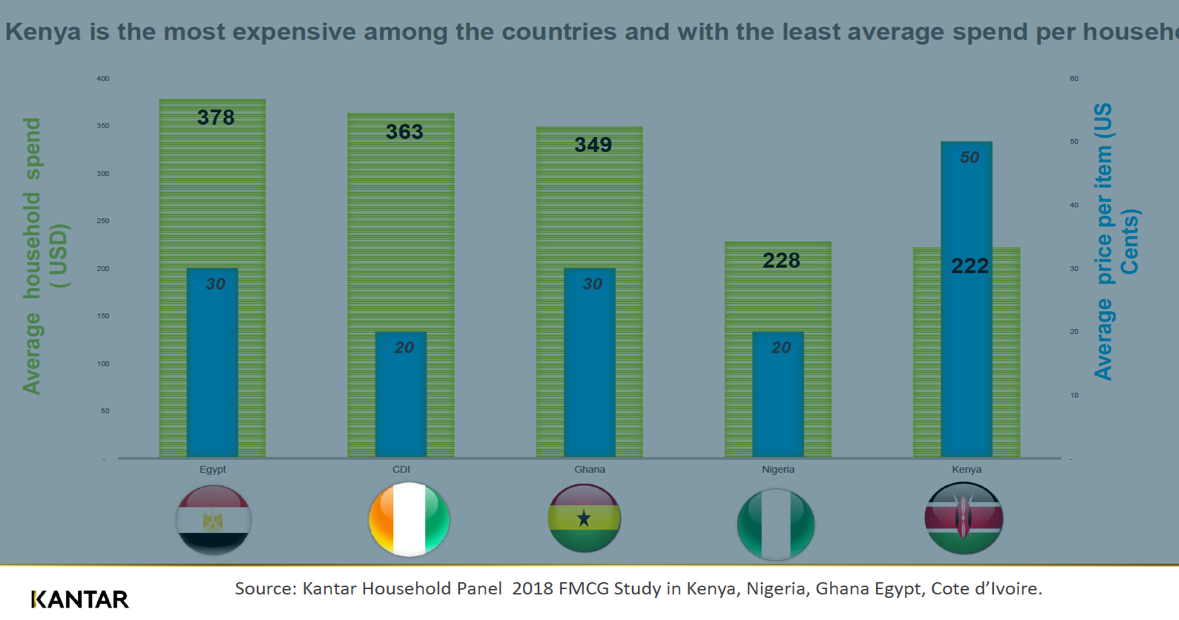

Kenya also has the lowest average household spend of about US $220 on FMCG (average spend per household on FMCG consumed in home per year) vs Nigeria, Ghana and CDI at US $228, US $349 and US $363 and is seen to be one of the most expensive of all the countries with average price of an item is about 50 cents vs Nigeria, Ghana and CDI at 20 cents, 30 cents and 20 cents [1].

Life still finds a way around it…How?

In this midst of this daily struggle for most Kenyans, the market is re-engineering to provide alternatives and options so that people can make ends meet.

Re-use: Gikomba, Toi and Korogocho markets are familiar places for Nairobi inhabitants where you can get a whole new wardrobe for as little as $10. They are value-for-money and offer items at very attractive and affordable prices.

Borrow now, pay later: A jingle synonymous with mortgage and insurance industry as you strive to bring your aspirations into an affordable space with the belief and promise of sustained future income.

Sharing is good: Informal micro savings groups that enable members to pool savings and use for investments an special occasions. Another example is that of “Little”, the cab service that unveiled a shuttle service in Nairobi to provide convenience and better-quality services at an affordable price.

Borrow now, pay later: Digital lending in Kenya has witnessed phenomenal growth in the last few years. Safaricom reports showed a whopping sum of KES45 billion was borrowed by Kenyans within three months of launching its credit facility Fuliza.

Pay as you go: M- KOPA Solar unveiled an off Grid Solar Innovation making access to electricity more affordable and accessible by allowing consumers to pay daily for using the device and eventually owning it at the end.

The impact on FMCG

An interesting finding from Kantar household research shows Kenyans make the least number of shopping trips in a year (300) vs Nigeria, Ghana & CDI at 393, 560 and 805. The key reason for this behavior in Kenya is the drive for “getting more for less”.With average Kenyan household spend on consumer products shrinking at 3% in 2018, the importance of affordability in driving consumption comes to the fore.

Right pack and price adaptation: A Kantar study showed that 80% of low-income household spend on local brands in Kenya was on big packs (>100g). This especially applies within home and personal care and average consumption of these have grown faster than small packs, implying that consumers are looking for value which many local brands are seen to be cashing in strongly on at the right price points. The price points of 5,10, 50, 100 shillings are where a lot of non-monthly purchase happens, and companies like Unilever are also playing in these segments to drive affordable consumption.

Re-fill: “Buy what you need”: Driving the “buy what you need” approach through dispensers is already picking up as a business model that can foster convenience and affordability; the growth of fresh milk and cooking oil “ATMs” in Kenya is a great example of this. In the Philippines, Unilever unveiled shampoo and conditioner refilling stations in a bid to help reduce the single-use plastic packaging use among consumers and drive affordability.

Right dosage: Teaching consumers right levels of product usage. Examples are packs with dosage amounts automatically understood (e.g.: Royco Cubes) or ideas like the brand “LESS” launched in Netherlands by Eric Smeding, an “intrapreneur” within Unilever where consumers get a device where they simply have to press once, twice or thrice to get the right amount of detergent powder for their wash loads.

Re-use: A coalition of companies including Unilever, Carrefour, UPS, along with TerraCycle, have come together in the USA to be part of LOOP, a global circular shopping platform designed to eliminate the idea of waste by transforming the products and packaging of everyday items from single-use to durable, multi-use, feature-packed designs.

Closer home, Unilever’s current collaborations with MrGreen & PETCO are examples of working towards sustainability and affordability.

As companies embrace these ideas, there is a need for sustained

collaborative effort by stakeholders in manufacturing, retailing and the

government towards driving sustainable new business and regulatory models which

can make products and services more affordable leading to an increase in consumption

and economic growth.

[1] Kantar Household panel 2018 FMCG Study in Kenya, Nigeria, Ghana, Egypt, Cote d’Ivoire. Kantar household panel study tracks FMCG categories (home care, personal care, foods and beverages) purchased and consumed in home at a household level only (not considering what is bought and consumed out of home).