Even if you’re not involved in investing, you’ve probably seen the GameStop story, which started on a Reddit community called WallStreetBets and went viral.

In case you haven’t: WallStreetBets members realised that hedge funds like Melvin Capital were shorting (i.e. investing in a way that will profit the investor if the value drops) GameStop stock ($GME), expecting its price to drop to make a profit, and decided to buy and hold the stock to drive the price up, causing the hedge funds to lose money.

We wanted to offer a perspective informed by market research, machine learning, econometrics and advanced analytics. Therefore, we decided to look on social media and other online sources (including the dark web) for learnings that weren’t obvious and consequently not in the news.

Although this isn’t classic market research, it has all the elements of a social intelligence based market research project. Social intelligence refers to the insights discovered through accurately annotated social and other online data. What it offers to market research is unsolicited opinion, which can be integrated with solicited opinion from surveys, and behaviour.

The Battle – Part 1

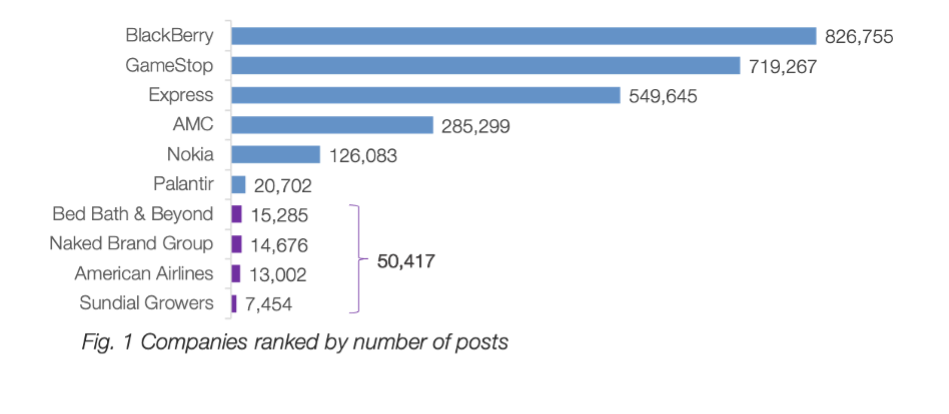

We initially gathered 3 million posts between December 1st 2020 – January 31st 2021, from Twitter, forums, blogs, news, videos, and reviews, using keywords such as “GameStop”, “GME”, and a few other stock tickers (the unique series of letters assigned to publicly listed companies) and terms. We also gathered the entire WallStreetBets subReddit (the specific forum on Reddit) between January 23rd – 31st 2021.

Once the data was gathered, AI analysed the posts and identified key topics and their sentiment, resulting in 8 key findings:

- YOLO (You Only Live Once)

This acronym appeared nearly 55,000 times — mostly as a verb — by small investors communicating that they were betting all they had on GameStop and other stocks, in some cases asking for advice or encouraging others to follow suit, and oddly enough, defying the end goal that’s usually behind an investment decision (making a profit).

2. Other Stock Tickers

Even though we only included keywords for a few companies other than GameStop to gather data, other companies such as Bed Bath & Beyond, American Airlines, Sundial Growers, and Naked Brand Group came up. As it turned out, retail investors were strongly recommending buying and holding these stocks for the same reason as $GME.

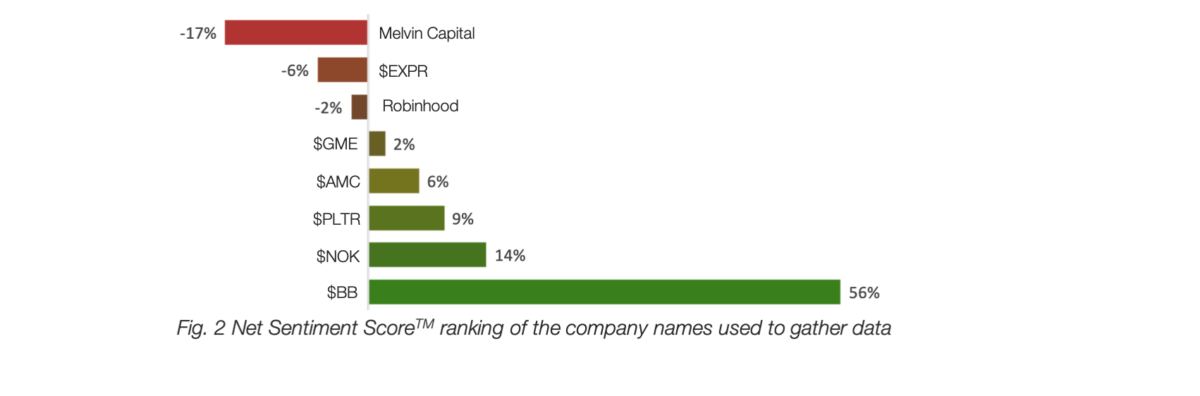

3. Net Sentiment Score (NSSTM)

Similar to the Net Promoter Score, the NSSTM (Net Sentiment ScoreTM) is a great way to rank brands and understand brand health and possibly predict stock price fluctuations. Unsurprisingly – given the public backlash, Melvin Capital has the lowest NSSTM at -17%; maybe what is a little surprising is that GameStop has a lower NSSTM than BlackBerry/Nokia/Palantir/AMC.

4. Elon Musk involvement

Some people — particularly on Twitter — believe that Elon Musk further supported the $GME rebellion with a tweet, which was perceived as him striking back at Melvin Capital because at some point in the past they had shorted Tesla, and apparently, he hates them for that.

5. Nokia & BlackBerry

Almost 1 million posts mention the once popular phone brands, as some of the stocks to keep an eye on and buy or hold so as to replicate the $GME effect. Both their stock prices peaked on January 27th at 6.55 USD and 25.10 USD respectively.

6. Correlation

Very high correlation between online buzz/sentiment and stock price is observed for companies such as GameStop, Express Inc. and AMC Entertainment – for which there is 83% positive correlation between the total buzz fluctuation and the stock price return.

Causation is obvious in this case: online posts recommending buying these stocks lead to actually buying the stocks, thus driving their value sky high.

7. FOMO

Albeit just a small percentage of the entire dataset, it’s interesting that just like YOLO, the acronym for “fear of missing out” comes up in online conversations close to 2,000 times. It seems that FOMO is a significant motivation to buy for some people.

8. A taste of the Dark Web

As we edit this we are a bit apprehensive because of the reputation of the dark web, but here is an example which could have easily been gathered from Reddit or Twitter for all we know.

The Battle – Part 2

After we published our December-January findings, in late February, $GME was on the rise again, with their share price jumping from 44.97 USD on February 23rd to 91.71 USD on February 24th, ultimately reaching 265.00 USD on March 10th. We gathered an additional 1.2 million posts for the month of February. One possible explanation for the second surge is the announcement of their CFO standing down on February 23rd.

Here are three other noteworthy findings:

1. Diamond hands

Posts mention “diamond hands” – a term used to describe holding i.e. not selling a stock no matter what, and include relevant emojis (e.g. 🙌💎 ), indicating that they will hold regardless of any price fluctuations. This has been mentioned many times across the web together with GME.

2. Influencing main street investors

A Reddit user who goes by the nickname “DVF” appears to be an influencer and in some cases even a role model, with other users mentioning him both on his own posts and on posts by third users. Some credit him as the reason they started studying about the stock market and building their portfolios, while others almost blindly follow his recommendations.

3. Community spirit

There is a real sense of community on Reddit. One user posted about their friend Alex passing away, to which many others responded with their support, saying they will hold GME and AMC for Alex. The two friends had promised each other they would “diamond hands” the stocks until they die.

Conclusion

For both parts of the report we used listening247 to gather a total of over 4 million posts from various online sources, to find out what happened behind the GameStop story.

The findings suggested there were several factors which influenced the unlikely rise of the $GME stock.

Social intelligence is not only useful for market research use cases such as brand/campaign evaluation and competitive analysis, but can also be used to predict fluctuations in the stock market. Global giants such as Bloomberg are already using this kind of datasets as valid alternative data for the discovery of “new alpha”, which is predictive of the active return of an investment.