Fast mobile internet speeds around the world have allowed us to watch more video content at exponential levels. This, in turn, has given rise to an extremely competitive video on-demand streaming service industry that’s growing and evolving quickly.

According to data presented by Fortune Business Insights, the market size of video streaming that was valued at USD $43.9 Bn in 2017 is expected to increase to USD $87.1 Bn by the end of the year 2025.

The video streaming market can be segmented into two broad categories:

- Ad-supported services such as YouTube

- Paid subscription-based platforms such as Netflix, Amazon Prime, Hulu and Hotstar

Both categories of video streaming services have experienced excellent growth – especially in the last couple of years.

While Google’s YouTube has an almost monopolistic hold in the ad-supported segment, it’s the subscription-based video streaming space that’s highly contested. The segment is currently experiencing fierce competition for dominance and is crowded with various platforms from different companies, all vying for the top position. In India alone, there are roughly 30 such services, all catering to different viewer demographics.

So, who is currently the leading subscription-based streaming services with the most consumer preferences?

To understand this, Borderless Access surveyed n=1,000 Video on Demand (VoD) streaming service viewers in both the US and India. This provided insight into, consumption patterns, preferences and consumer sentiments on VoD.

Consumption Patterns

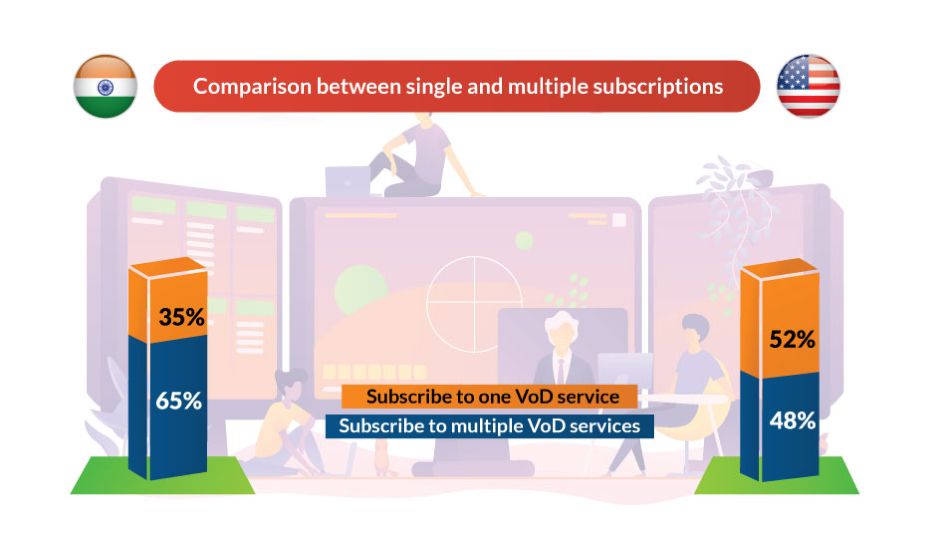

Most viewers in India have subscribed to more than one VoD service compared to the US where the majority subscribe to a singular service.

This indicates the evolved state of VoD in the US where viewers have already picked their preferred streaming platforms. Conversely, the VoD segment is still in its infancy in India, with multiple service providers battling for users’ loyalty.

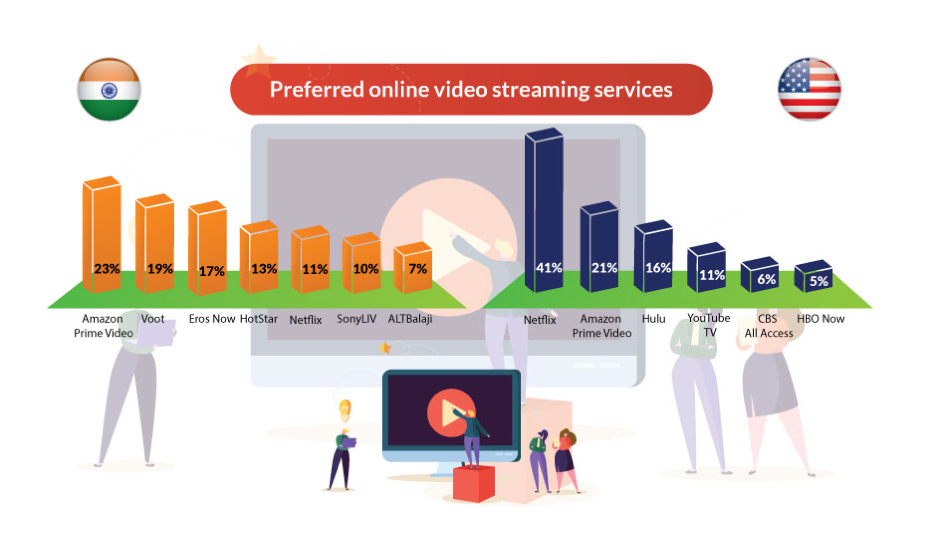

This trend reflects viewer preference for streaming platforms as well. In India, viewership is scattered amongst half a dozen different platforms, showing that the race has only just started.

In contrast, the result from the US shows Netflix has a clear lead over other platforms, with Amazon Prime Video following at a distant 2nd position.

Regardless of the maturity of the markets, it’s interesting to note that the content consumption pattern during the day is very similar, where most content is consumed in the evening and night time.

Enter the Giants

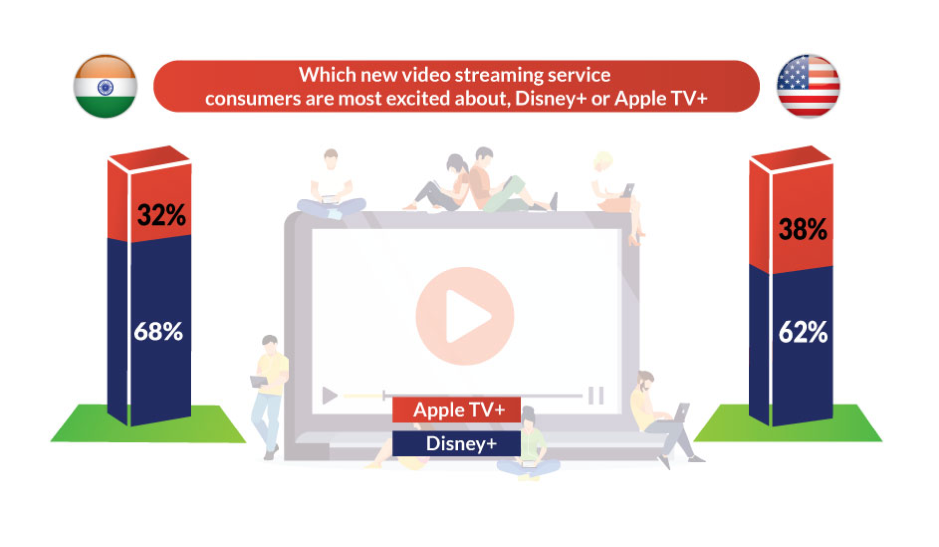

Next year, however, might witness some major upheaval in the VoD space once the two behemoths – Disney and Apple – enter the market with their newly launched services.

Both Apple TV+ and Disney+ can potentially upset the status quo of the industry. On one hand, Apple has access to a large audience that is tied-in to its well-established app and device ecosystem. And it already has a list of exciting original content, created in partnership with A-grade actors and content creators. Disney+ meanwhile has a trump card under its sleeve in the form of a massive archive of exclusive popular content, which it can always bank on, as well as new content.

And viewer sentiments captured by our study points towards a win for Disney, which should hold true at least initially, especially considering the decades of experience and content they have. This is also likely due to its availability on all platforms. Whereas, Apple+ is limited to iOS and Mac OSes and a few Smart TVs and streaming devices. In a market like India, where the vast majority of viewers own Android devices, Apple is on the back foot right from the start.

Too Much Choice?

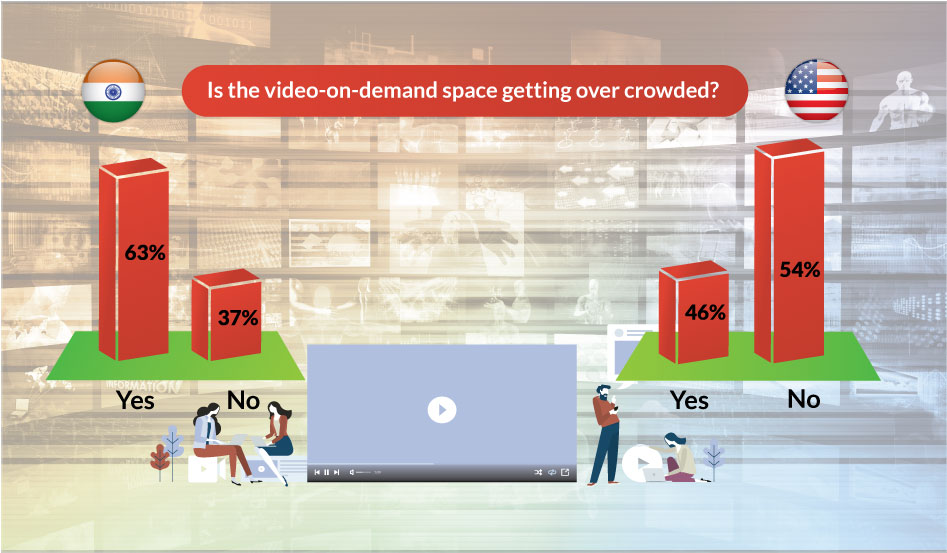

Are we approaching a threshold in terms of the number of options available to viewers? At some point, the burden of having to choose between too many options will lead to user fatigue. This could end in a catastrophic failure of one or more platforms. Fortunately, the industry has not reached that tipping point yet.

Conclusion

Going by these observations, we can be certain of at least one thing that the VoD space is far from saturated. There’s still plenty of space for existing players to grow and capitalize and even new ones to take root in emerging markets like India. While consolidation is inevitable after a period of time, there’s also plenty of room for multiple large players to exist. Of course, it’ll be interesting to see how the consumer sentiments change for the present dominant VoD players in the developed markets with strong new players getting into the picture. It will be long before things settle down and there’s plenty of opportunities for players to win this race to the top of the hill.

About the study:

Markets – India and US

Sample size – n=1,000 per market

Sample demographic – 50/50 male/female, aged 25-55